Andamento Titoli Bancari : Rendimenti fino al 8.15% in 14 Giorni

Andamento Titoli Bancari

Andamento Titoli Bancari: questa strategia di investimento fa parte del pacchetto ‘’Titoli Bancari”, una delle diverse categorie delle soluzioni di investimento quantitativo.

- Top 10 tra i titoli per le posizioni lunghe

- Top 10 tra i titoli per le posizioni corte

Nome del pacchetto: Titoli Bancari

Posizioni raccomandate: Long

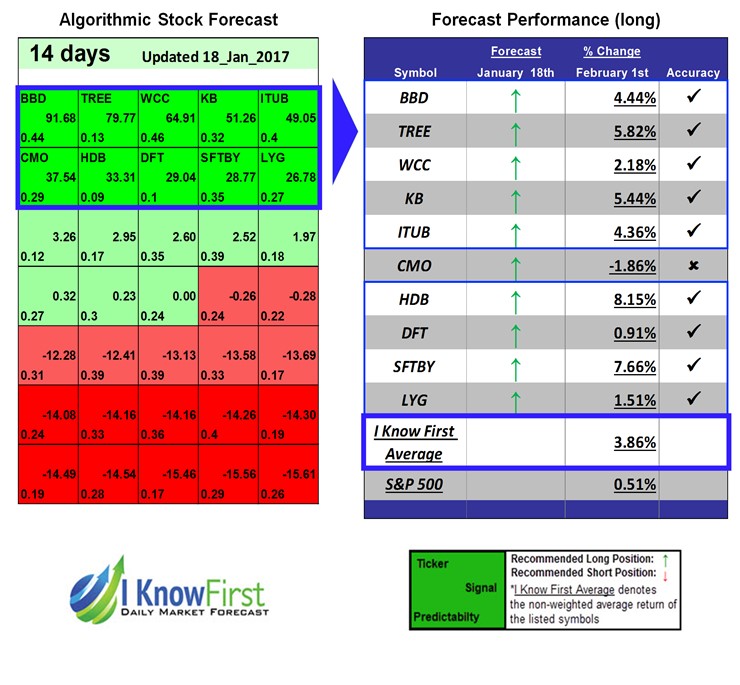

Orizzonte temporale di previsione: 14 Giorni (18/01/2017 – 01/02/2017)

Media di I Know First: 3.86%

Il nostro algoritmo allo stato dell’arte ha previsto correttamente 9 su 10 posizioni nel pacchetto Titoli Bancari per il seguente orizzonte temporale: 14 Giorni. Il rendimento più elevato è arrivato da HDB con il 8.15%. Anche SFTBY e TREE hanno ottenuto buoni risultati per questo orizzonte temporale con il 7.66% e 5.82%. Il pacchetto ha ottenuto un rendimento medio del 3.86%, portando agli investitori un premium del 3.35% su quello dell’S&P 500 del 0.51% nel corso dello stesso orizzonte temporale.

HDFC Bank Limited (HDB) provides a range of banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. The company operates in Treasury, Retail Banking, Wholesale Banking, and Other Banking Business segments. It accepts savings accounts, salary accounts, current accounts, fixed and recurring deposits, demat accounts, safe deposit lockers, and rural accounts, as well as offshore accounts and deposits. The company also offers personal, business, home, consumer durable, car, two wheeler, gold, educational, rural, and term loans; loans for professionals; loans against property, securities, and assets; overdrafts; government sponsored programs; and working capital, healthcare, channel, short term, structured, dealer, and vendor finance, as well as agricultural lending. In addition, it provides credit, debit, and prepaid cards; private banking services; export, import, remittance, bank guarantees, and letter of credit services, as well as merchant and cash management services; life, health, motor, travel, home, and insurance products; and investment product, such as mutual funds, equities and derivatives, IPO, gold and silver investments, and bonds. Further, the company offers bill discounting, real time gross settlement, bankers to right/public issue, forex, money market, employees trusts, and tax collection services; and investment banking services in the areas of project appraisal, structured finance, loan syndication, debt capital markets, equity placement, mergers and acquisitions, corporate advisory, and capital market advisory services. Additionally, it provides correspondent banking, settlement, custodial, disbursement, clearing, and administrative and fiduciary support services, as well as online and mobile banking services. As of March 31, 2016, the company operated a network of 4,520 branches and 12,000 ATMs in 2,587 cities/towns. HDFC Bank Limited (HDB) was founded in 1994 and is based in Mumbai, India.

I trader utilizzano le previsioni giornaliere di I Know First come un strumento per accrescere la performance del loro portafoglio, verificando le loro analisi e agendo sul mercato attraverso le migliori opportunità. Questa previsione è stata mandata ai trader di I Know First.

Come interpretare questo diagramma

Prego notare che per le decisioni di trading bisogna osservare le previsioni più recenti. . Ricevi le previsioni di oggi