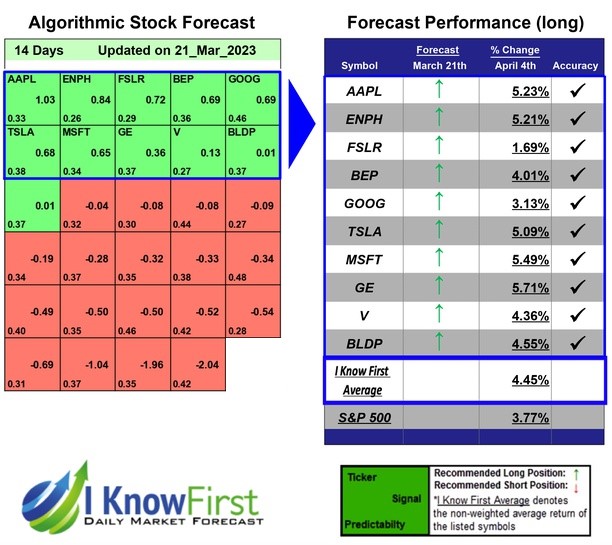

Sustainable Stocks Based on Big Data Analytics: Returns up to 5.71% in 14 Days

Sustainable Stocks

The sustainable and responsible companies’ stocks package provides stock forecast for the best stocks to buy based on Barron’s top 100 Sustainable and Responsible companies list. These 100 companies are selected for 3 main factors: environmental, social and corporate governance. The stock forecast includes 20 stocks with bullish and bearish signals and indicates the best shares to buy and sell:

- Top 10 sustainable and responsible stocks for the long position

- Top 10 sustainable and responsible stocks for the short position

Package Name: Sustainable and Responsible Companies

Recommended Positions: Long

Forecast Length: 14 Days (3/21/23 – 4/4/23)

I Know First Average: 4.45%

I Know First’s State of the Art Algorithm accurately forecasted 10 out of 10 trades in this Sustainable and Responsible Companies Package for the 14 Days time period. The top performing prediction from this package was GE with a return of 5.71%. MSFT and AAPL had notable returns of 5.49% and 5.23%. This algorithmic forecast package presented an overall return of 4.45% versus the S&P 500’s performance of 3.77% providing a market premium of 0.68%.

General Electric Company (GE) (GE) operates as an infrastructure and financial services company worldwide. The company’s Power segment offers gas and steam power systems; maintenance, service, and upgrade solutions; distributed power gas engines; water treatment, wastewater treatment, and process system solutions; and nuclear reactors, fuels, and support services. Its Renewable Energy segment provides wind turbine platforms, and hardware and software; offshore wind turbines; and solutions, products, and services to hydropower industry. The company’s Oil and Gas segment provides turbomachinery solutions; surface and subsea drilling and production systems, and equipment for floating production platforms; measurement and control products; and compressors, pumps, valves, and natural gas solutions. Its Energy Management segment offers industrial and grid solutions; and power conversion systems. The company’s Aviation segment designs and produces commercial and military aircraft engines, integrated digital components, electric power, and mechanical aircraft systems; and provides aftermarket services. Its Healthcare segment offers diagnostic imaging and clinical systems; products and services for drug discovery, biopharmaceutical manufacturing, and cellular technologies; and healthcare information technology products. The company’s Transportation segment provides freight and passenger locomotives, parts, wreck repair, software-enabled solutions, mining equipment and services, marine diesel engines, and stationary power diesel engines and motors, as well as overhaul, repair, and upgrade services. Its Appliances & Lighting segment sells and services home appliances; and manufactures, sources, and sells lighting solutions. The company’s Capital segment offers commercial lending and leasing, factoring, energy financial, and aircraft financing and leasing services. General Electric Company (GE) was founded in 1892 and is headquartered in Fairfield, Connecticut.

Algorithmic traders utilize these daily forecasts by the I Know First market prediction system as a tool to enhance portfolio performance, verify their own analysis and act on market opportunities faster. This forecast was sent to current I Know First subscribers.

How to interpret this diagram

Algorithmic Stock Forecast: The table on the left is a stock forecast produced by I Know First’s algorithm. Each day, subscribers receive forecasts for six different time horizons. Note that the top 10 stocks in the 1-month forecast may be different than those in the 1-year forecast. In the included table, only the relevant stocks have been included. The boxes are arranged according to their respective signal and predictability values (see below for detailed definitions). A green box represents a positive forecast, suggesting a long position, while a red represents a negative forecast, suggesting a short position.

Please note-for trading decisions use the most recent forecast. Get today’s forecast and Top stock picks.